What Happened to LPO?

An exhaustive readout

Over the last couple of weeks, we have seen Takes flying left and right about the energy provisions in Republicans’ reconciliation package – some thoughtful, some signaling, and others just plainly wrong about key details.

Given this mix, the confusion that has ensued in both the media and policy worlds is understandable. In particular, there appear to be two major areas of uncertainty: first, the workability of the energy tax credits’ “foreign entity of concern” (FEOC) rules, and second, the status of the Department of Energy’s Loan Programs Office (LPO).

The FEOC side of this deserves much more than a blog post – but as a starting point, I would direct readers to Norton Rose Fulbright’s recent podcast episode on these and related issues. I think it gives one of the clearest readouts to date.

In this post, we’ll focus on where the One Big Beautiful Bill Act (OBBBA) left us on LPO’s three major programs: the Advanced Technology Manufacturing Vehicles program (ATVM), the Clean Energy Financing program (1703), and the Energy Infrastructure Reinvestment program (1706).

Where we were, where we are:

The Loan Programs Office has been issuing loans for over fifteen years. The IRA represented by far the largest injection of credit subsidy into LPO, but was by no means the first bill to give LPO substantial loan authority – and while the OBBBA had major implications for LPO’s credit subsidy, it more or less left its loan authority intact. We’ll explain these two concepts here.

Loan Authority:

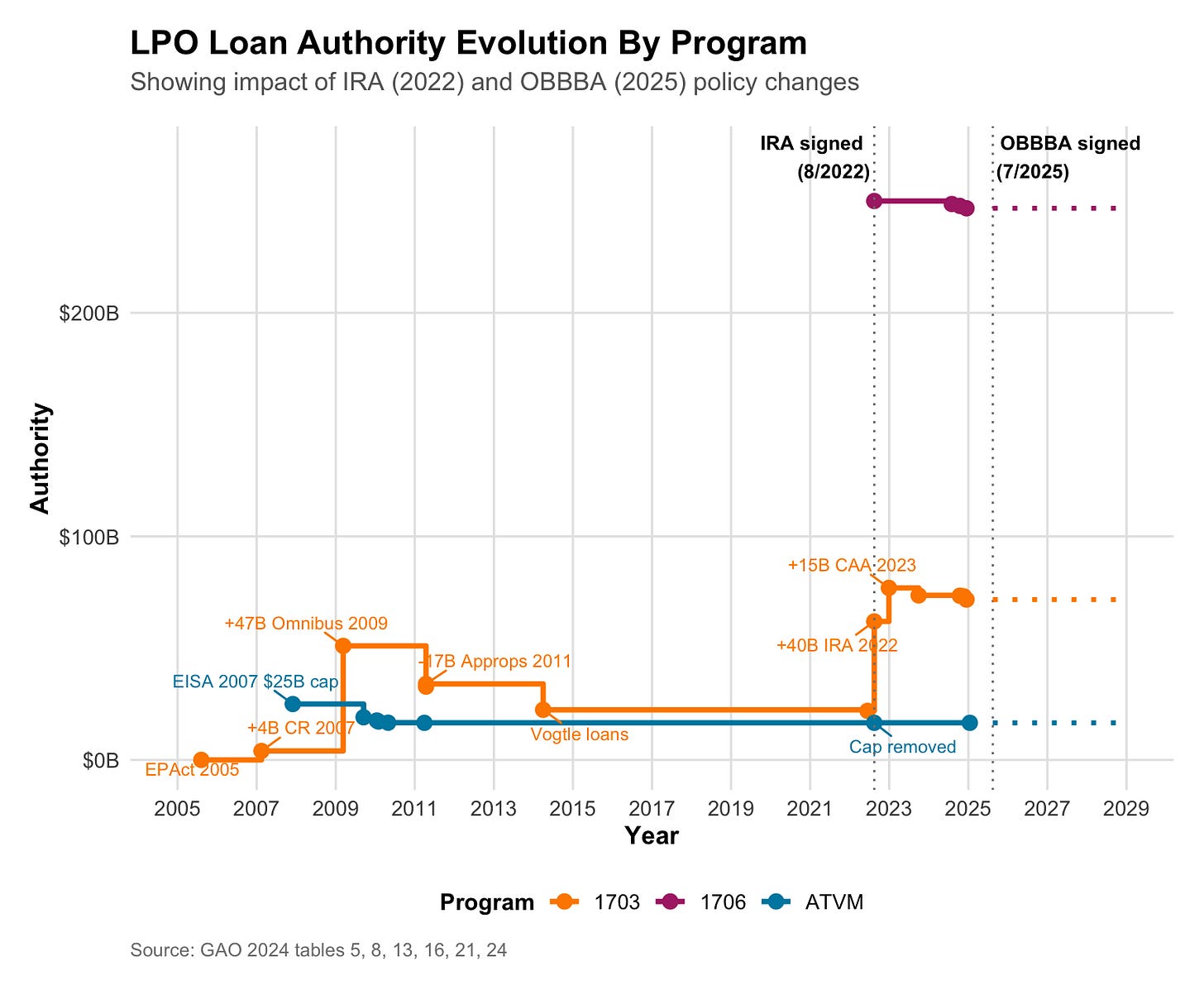

Loan authority is exactly what it sounds like: it represents the upper limit of how much LPO can issue in loans. LPO’s three biggest programs have had various injections and rescissions of loan authority over the years.

For the 1703 program, the first major changes came in 2009 when the omnibus added $47 billion in loan authority, and again in 2011 when $17 billion was rescinded in appropriations. The IRA added an additional $40 billion of loan authority, and appropriations in 2023 added another $15 billion. The OBBBA did not change 1703’s loan authority, leaving around $70 billion in remaining authority.

For the ATVM program, the Energy Independence and Security Act created $25 billion in loan authority in 2007. The IRA then got rid of the cap, and thus its spending over the last few years left its pre-IRA loan authority unaffected. The OBBBA reinstated the pre-IRA cap (it would seem, anyway – still confirming this detail), and otherwise did not change ATVM’s loan authority, leaving around $17 billion in remaining authority.

For the 1706 program, the Inflation Reduction Act created $250 billion in loan authority. The OBBA did not change 1706’s loan authority, leaving ~$200+ billion intact.

In summary: 1703, ATVM, and 1706 have around $70 billion, $17 billion, and $200 billion of loan authority remaining, respectively.

Credit Subsidy:

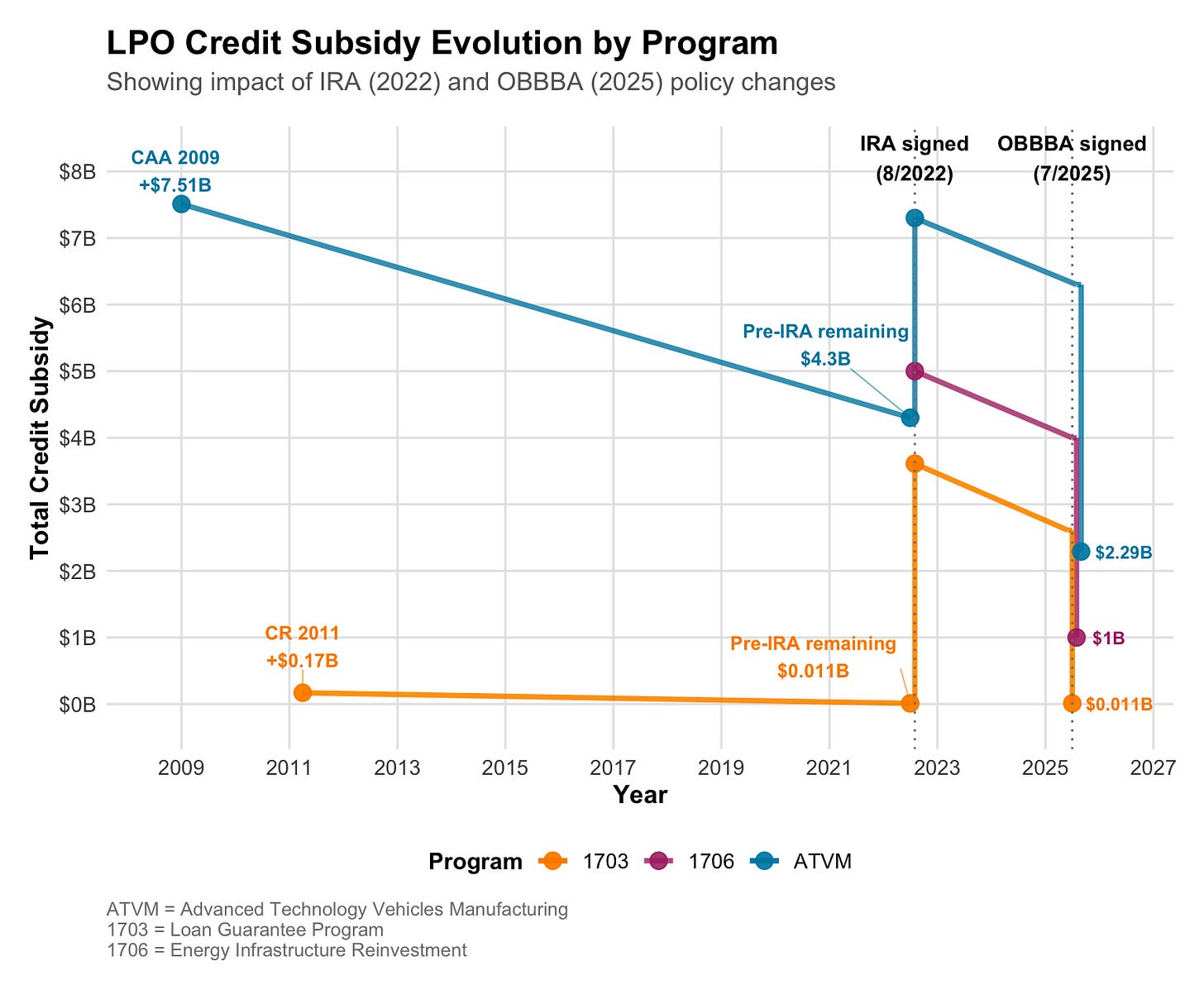

Credit subsidy is quite a bit more complicated than loan authority: it represents, in rough terms, the level of default risk associated with an individual loan – that is, how likely the borrower is to be unable to repay the loan. As such, riskier loans tend to require higher credit subsidy, while safer loans tend to require lower credit subsidy.

Credit subsidy values are generally not made public, and as such it’s difficult to communicate which project types require what level of subsidy. In theory, a billion dollar loan could require hundreds of millions of dollars of credit subsidy – or it could require zero. But in general, LPO’s credit subsidy costs are substantially lower than most people realize.

As LPO senior advisor Kyle Winslow noted post-OBBBA, “some Title 17 projects that are creditworthy enough may not require much, or any, credit subsidy, underscoring the importance of OBBBA’s preservation of that IRA Title 17 loan authority.” In other words: some loans, including nuclear loans, use zero credit subsidy. There’s also borrower pay, in which the borrower pays the cost of the credit subsidy. This is relatively common when loans are issued to large investor owned utilities.

To concretize this with some numbers we do have: LPO’s 1703 program only had $170 million in credit subsidy prior to 2022 – and yet it issued upwards of $12 billion in loans. This is certainly the upper bound of how much loan value credit subsidy can support (as this ratio would imply that $1 billion in credit subsidy could support $70B in loans, which is extremely unlikely to be the case moving forward), but it also demonstrates that the sort of modeling which suggests that $1 billion in loans would only support, say, $10 billion in brownfield loans is substantially off base. The true answer is probably somewhere in the middle.

With that out of the way…

For the 1703 program, 2011 appropriations added $170 million of credit subsidy. Then the Inflation Reduction Act came along and added a whopping $3.6 billion of credit subsidy; appropriations rescinded $150 million the next year. The OBBBA rescinded all of the IRA's unobligated credit subsidy, leaving just $11 million in the program.

(An important note here: the House’s appropriations language dropped last week, and would add $150 million of credit subsidy back into 1703.)

For the ATVM program, 2009 appropriations added $7.5 billion in credit subsidy. The IRA added an additional $3 billion. The OBBBA rescinded the IRA's unobligated credit subsidy, but not the prior existing subsidy, leaving around $2.3 billion in the program.

For the 1706 program, the IRA created the program with $5 billion in credit subsidy. The OBBBA rescinded the IRA's unobligated credit subsidy and replaced it with $1 billion (alongside a broader remit, which allows for greenfield energy projects).

In summary: 1703, ATVM, and 1706 have around $11 million (with the near-term possibility of $161 million), $2.3 billion, and $1 billion of credit subsidy remaining, respectively.

Pulling it together:

Where does this leave us?

On loan authority, the Loan Programs Office is in reasonably good shape – $17 billion in ATVM, $70ish billion in 1703, and $200ish billion in 1706. That should be enough for the office to chug along for the next few years.

On credit subsidy, things are more in the realm of “workable.” $1 billion in 1703/1706 and $2.3 billion in ATVM isn’t much compared to the volume of loans that the administration would like to see LPO issue in the next few years (eg, 10 new reactors under construction by 2030). At the same time, as we’ve discussed above, $1 billion can also support quite a bit more than many think – tens of billions of dollars worth of loans in total. In short: It’s a damn shame that the OBBBA rescinded as much credit subsidy as it did – but the LPO is still open for business.

In upcoming appropriations fights and beyond, credit subsidy will need the most attention. I’m hopeful that this round will go the right way for 1703, and am optimistic there will be future funding efforts in the years ahead.

Above all, though, my hope is that everyone recognizes where we were in June when the House package dropped – with every dollar of IRA credit subsidy rescinded and no new dollars to replace it. The fact that there is now new (albeit small) credit subsidy in the program, with a Republican stamp of approval attached, means a great deal for the durability of the office. That, to me, is reason for optimism.